Showing posts with label US Government. Show all posts

Showing posts with label US Government. Show all posts

Thursday, 19 February 2009

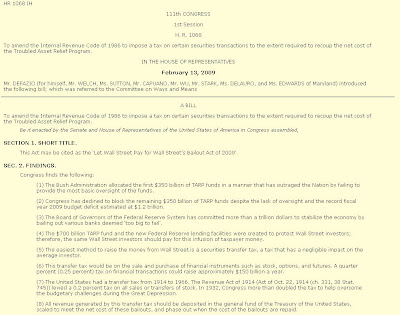

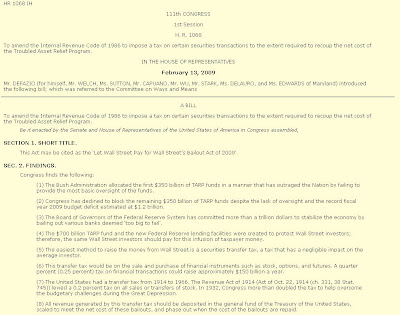

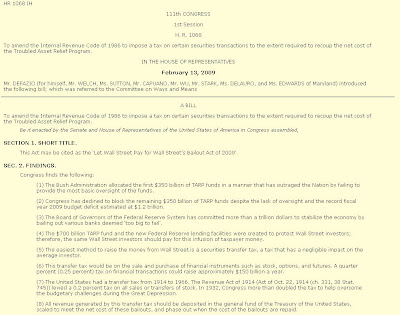

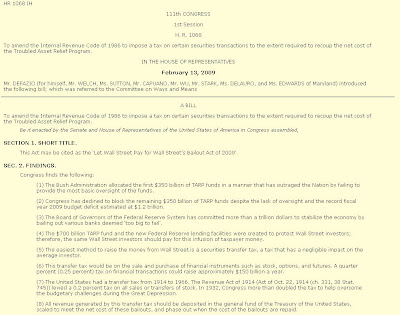

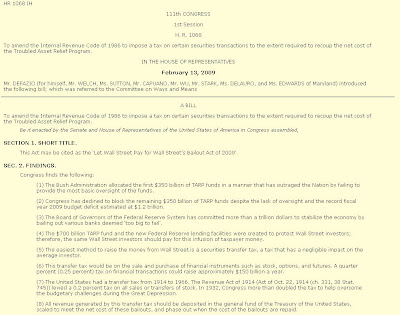

HR 1068 amendment

Traders may be taxed even more, "to recoup the net cost of the Troubled Asset Relief Program" if the HR 1068 bill passes.

Labels:

US Government

HR 1068 amendment

Traders may be taxed even more, "to recoup the net cost of the Troubled Asset Relief Program" if the HR 1068 bill passes.

Labels:

US Government

Monday, 22 September 2008

FED owns Wall Street

Mergers and acquisitions. Make no mistake about. Wall Street will never be the same.

The FED now owns Wall Street.

The FED now owns Wall Street.

Labels:

market crash,

stock market crash,

US Government

FED owns Wall Street

Mergers and acquisitions. Make no mistake about. Wall Street will never be the same.

The FED now owns Wall Street.

The FED now owns Wall Street.

Labels:

market crash,

stock market crash,

US Government

Sunday, 21 September 2008

A Financial Train Wreck

A few quotes from this week-

"I don't want the American taxpayer to get this bad debt and then the guy (whose company once held the bad loans) gets millions of dollars on his way out the door," said House Financial Services Chairman Barney Frank, D-Mass.

Paulson said that "it pains me tremendously to have the American taxpayer put in this position but it is better than the alternative."

My edge is completely gone and the government is now in full control of your money. So sad. (howardlindzon)

When the markets inevitably start going into freefall again, everyone will say "That short covering rally should be coming soon. Oh wait, no short-sellers??? Damn, maybe shouldn't have banned that..." (HCF comment on bigpicture)

The U.S. Government's historic reaction to the financial crisis firmly puts us in a place not seen in generations. We have officially crossed the line from capitalism to socialism in less than a week. The Fed synthetically owns Wall Street as we speak. The historic checks and balances built into the system, e.g., the ability to freely buy and sell, have been suspended for a large segment of the market. While the sayings "Wall Street privatizes gains and socializes losses" and "When there is too much capitalism you need a little socialism, and when there is too much socialism you need a little capitalism" have had symbolic meaning to me, they have never sounded so true than they have this week. (Information Arbitrage)

Labels:

blog,

stock market crash,

US Government

A Financial Train Wreck

A few quotes from this week-

"I don't want the American taxpayer to get this bad debt and then the guy (whose company once held the bad loans) gets millions of dollars on his way out the door," said House Financial Services Chairman Barney Frank, D-Mass.

Paulson said that "it pains me tremendously to have the American taxpayer put in this position but it is better than the alternative."

My edge is completely gone and the government is now in full control of your money. So sad. (howardlindzon)

When the markets inevitably start going into freefall again, everyone will say "That short covering rally should be coming soon. Oh wait, no short-sellers??? Damn, maybe shouldn't have banned that..." (HCF comment on bigpicture)

The U.S. Government's historic reaction to the financial crisis firmly puts us in a place not seen in generations. We have officially crossed the line from capitalism to socialism in less than a week. The Fed synthetically owns Wall Street as we speak. The historic checks and balances built into the system, e.g., the ability to freely buy and sell, have been suspended for a large segment of the market. While the sayings "Wall Street privatizes gains and socializes losses" and "When there is too much capitalism you need a little socialism, and when there is too much socialism you need a little capitalism" have had symbolic meaning to me, they have never sounded so true than they have this week. (Information Arbitrage)

Labels:

blog,

stock market crash,

US Government

Saturday, 20 September 2008

US Government manipulates Stock Market

The SEC's actions on Thursday to BAN short Selling on Financials was CORRUPT.

But what where they suppose to do?

Let WaMu go under, which would then cause the FDIC to fail because there wasn't enough reserves to cover the customers deposits(overleveraged), which in turn would cause a run on the banks, which in turn,,,,,A CHAIN REACTION....

We have a major problem now. Traders do not believe this run up in the stock market. IT WAS MANIPULATED BY THE US GOVERNMENT. This is NOT A FREE MARKET.

The Traders that covered there shorts WILL NOT BUY FINANCIALS and the common investors will not BUY at these levels. THAT IS WHAT EVERYONE THINKS. One way markets fall off cliffs. The SEC and US government made another bad choice.

AirelonTrading

Jefferson Kroll got ZOLTED-

But what where they suppose to do?

Let WaMu go under, which would then cause the FDIC to fail because there wasn't enough reserves to cover the customers deposits(overleveraged), which in turn would cause a run on the banks, which in turn,,,,,A CHAIN REACTION....

We have a major problem now. Traders do not believe this run up in the stock market. IT WAS MANIPULATED BY THE US GOVERNMENT. This is NOT A FREE MARKET.

The Traders that covered there shorts WILL NOT BUY FINANCIALS and the common investors will not BUY at these levels. THAT IS WHAT EVERYONE THINKS. One way markets fall off cliffs. The SEC and US government made another bad choice.

AirelonTrading

Jefferson Kroll got ZOLTED-

Labels:

SEC,

US Government,

video

US Government manipulates Stock Market

The SEC's actions on Thursday to BAN short Selling on Financials was CORRUPT.

But what where they suppose to do?

Let WaMu go under, which would then cause the FDIC to fail because there wasn't enough reserves to cover the customers deposits(overleveraged), which in turn would cause a run on the banks, which in turn,,,,,A CHAIN REACTION....

We have a major problem now. Traders do not believe this run up in the stock market. IT WAS MANIPULATED BY THE US GOVERNMENT. This is NOT A FREE MARKET.

The Traders that covered there shorts WILL NOT BUY FINANCIALS and the common investors will not BUY at these levels. THAT IS WHAT EVERYONE THINKS. One way markets fall off cliffs. The SEC and US government made another bad choice.

AirelonTrading

Jefferson Kroll got ZOLTED-

But what where they suppose to do?

Let WaMu go under, which would then cause the FDIC to fail because there wasn't enough reserves to cover the customers deposits(overleveraged), which in turn would cause a run on the banks, which in turn,,,,,A CHAIN REACTION....

We have a major problem now. Traders do not believe this run up in the stock market. IT WAS MANIPULATED BY THE US GOVERNMENT. This is NOT A FREE MARKET.

The Traders that covered there shorts WILL NOT BUY FINANCIALS and the common investors will not BUY at these levels. THAT IS WHAT EVERYONE THINKS. One way markets fall off cliffs. The SEC and US government made another bad choice.

AirelonTrading

Jefferson Kroll got ZOLTED-

Labels:

SEC,

US Government,

video

Thursday, 18 September 2008

SEC Bails out Wall Street, Shorts forced to covere September 19, 2008

SEC bans short-selling of 799 financial stocks

This is market manipulation at its greatest. It happens on a quadruple witching OPEX Friday. US citizens will pay in the end.

This is market manipulation at its greatest. It happens on a quadruple witching OPEX Friday. US citizens will pay in the end.

Labels:

market reversal,

SEC,

US Government

Tuesday, 16 September 2008

AIG bailout- help save the world

I can't help but laugh at the auctions going on at Ebay. Last night I saw an auction for Lehman Brothers for 99 million. This one is even better. AIG save the world Bag

The Sellers name is hopingforseverance and this is the description of the Bag-

"As you may have heard, an AIG collapse is imminent and would cause a catastrophic global economic depression. In order to stave off such a catastrophic event AIG needs $20 Billion in capital. Therefore, to rescue the world from this debacle, I am auctioning off this authentic AIG Emergency Bag in hopes of raising the required $40 Billion. This very stylish bag can be used as a backpack during both emergency and non-emergency situations and can hold up to $75 Billion (must use really large denomination bills) which is exactly the amount needed to salvage AIG from ruin. Although not photographed here, the bag comes with a pair of goggles and a gas mask issued to me on orientation day at AIG. The gas mask is unused, however I did put the goggles on a few times and run around the office (Christmas parties, Wednesdays, things like that)."

In real news- The Government is Bailing out AIG for $75 Billion.

"The Federal Reserve said Tuesday it would provide up to $85 billion in an emergency, two-year loan to rescue AIG, which teetered on the edge of failure because of stresses caused by the collapse of the subprime mortgage market and the credit crunch that ensued. In return, the government will get a 79.9 percent stake in AIG and the right to remove senior management.")(Reuters)

Labels:

AIG,

Bernanke,

Fed Funds Futures,

market crash,

Paulson,

US Government