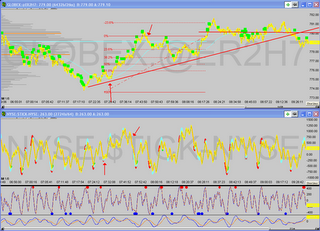

The reversal occured at 7:18am below the 70% volume profile level. After 2 hours we reversed again at 9:18am at the high volume profile area to return to the highest volume area of the day.Yesterdays lower volume profile extenstion at 781 acted as resistance today.

Overall my perfomance today was bad even though I had a positive P/L. Today I hesitated on taking my signals because I was watching my range NYSE TICK chart and only wanted to take a long entry off of a TICK pullback, which did occur, but I thought the NYSE TICK looked to high for an entry, so I kept watching and the price kept going up and I never got in the trade because I didn't want to chase it.

Checkout the Volume profile for the last week, you can clearly see the trend. I'll be watching for a possible reversal.

0 comments:

Post a Comment